- cross-posted to:

- technology@lemmy.world

- cross-posted to:

- technology@lemmy.world

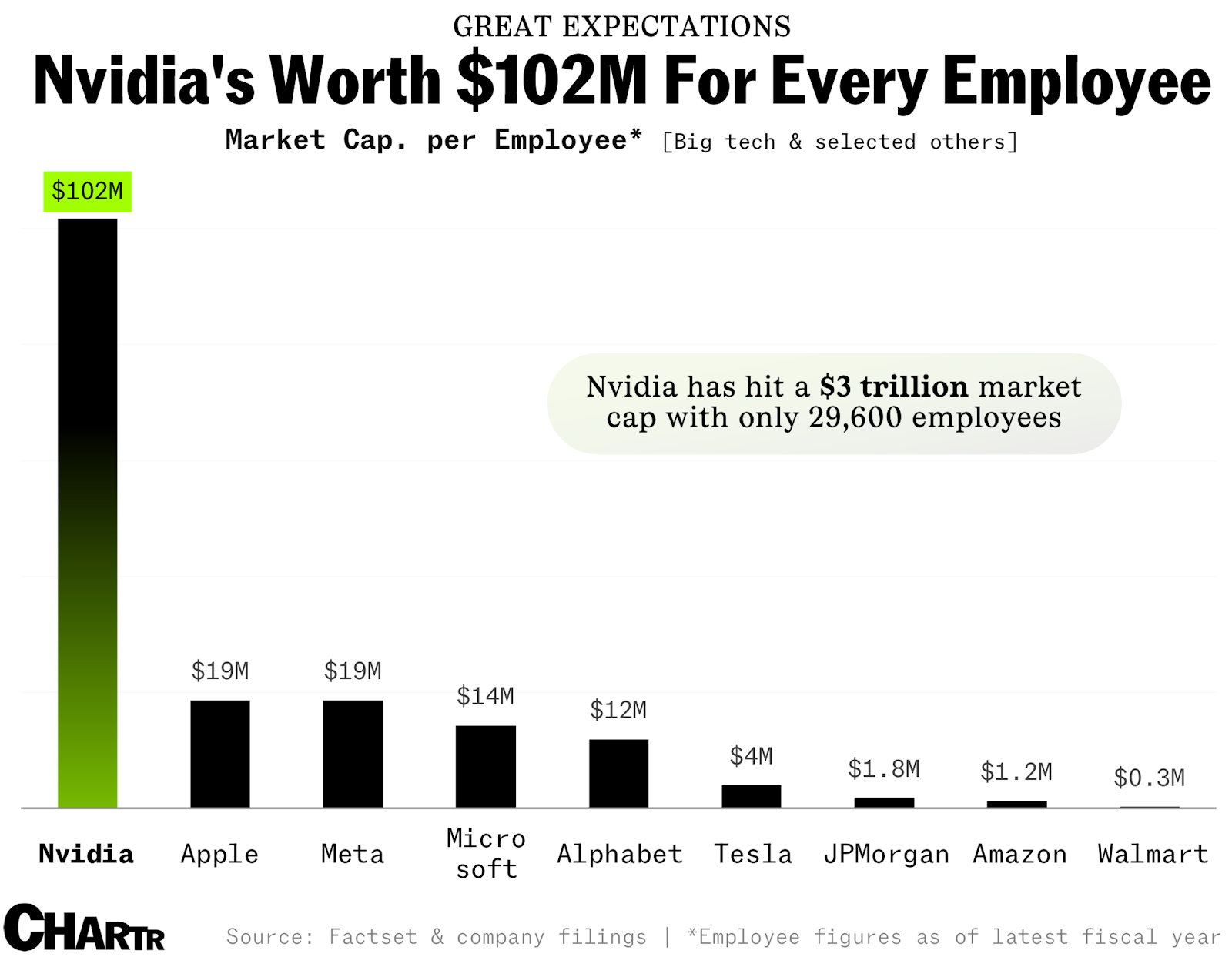

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

Are they gonna pay them out? /s

Every employee could create their own companies and products. Opportunities and diversification!

Alternatively, each and every one of them can make 101 millionaires and still be a millionaire themselves!

AI is certainly a bubble but Nvidia has been working on this stuff long before the hype. I don’t think you can easily dismiss them. Personally I don’t think the future of AI is giant data centres, it will be running in desktops GPUs and dedicated AI chips. It already is.

It will be both. AI local and AI cloud.

For the average person every day use AI will be local on device. But companies with massive data sets will be processed with a data center.

In Nvidia’s case that’s actually true for long tenured employees - assuming they cash out before the bubble bursts.

-

“Are the employees gonna see a cent of this?”

-

“Fuck, no!”

Well, they technically will see SOME cents of this because I’m pretty sure Nvidia gives employees stocks too.

But yeah, I also posted this because it’s a clear illustration of how most salaries will never reflect the value your labour brings to an organization.

Or more accurately, it’s a clear illustration of how overvalued they are right now.

But as the saying goes, the market can remain irrational longer than you can remain solvent.

I’ll just leave this here.

https://www.businessinsider.com/nvidia-employees-rich-happy-problem-insiders-say-2023-12

-

The great thing about the stock market compared to other investments like crypto is that stocks are based on the inherent value of the business they represent. Stocks are based on financial fundamentals. You can believe in those investments because they are based on something real and not simply rampant speculation. For example.

Tesla. Worth more than most of the rest of the car market combined because… reasons?

Paypal. Lost 80% of its value starting in July 2021 over a year and never recovered because of terrible problems? Huge losses? Nope, because it “only” grew at 8-9%.

2008 US housing rated as “AAA” investment i.e. “good as cash” based on actual trash.

because they are based on something real and not simply rampant speculation.

/s

I mean… It would be true if there were no derivatives. When you start betting money on whether the line goes up or down, the stock price cases being reflective of the stock’s value.