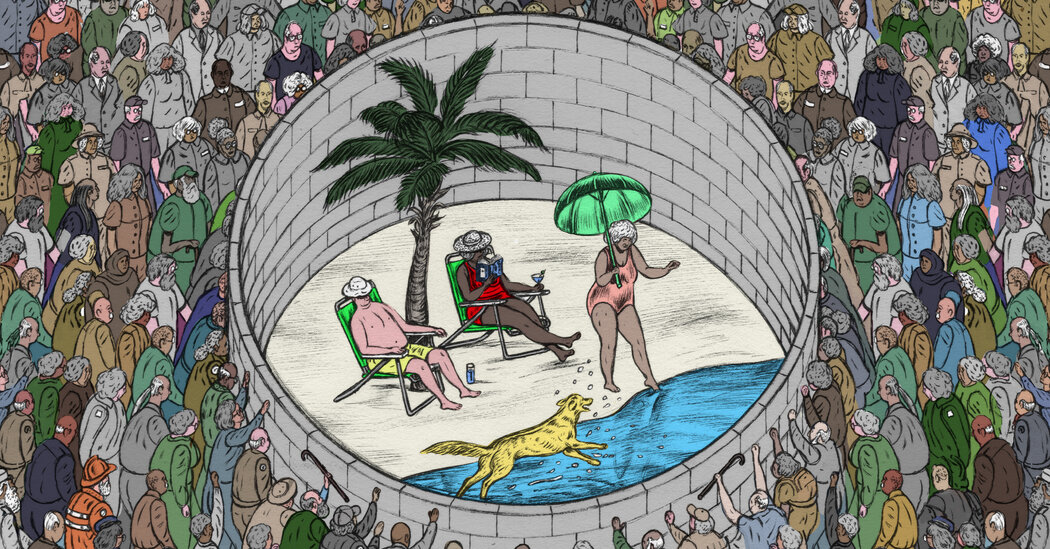

Maybe giving a percentage of your income to legal gambling is a bad idea???

No, the article is actually saying that people have not done this enough. Workers were better off when their employees did so for them and mandatorily (a pension system), and allowing folks to self manage how much they put away is what has led to 49% of folks within 10 years of retirement having nothing to retire on.

There are very safe ways to invest. Doing it poorly and a lot is a gamble; taking a little time to understand different investment vehicles and portfolios and the risks associated with each allows you to earn interest at literally any level of risk. An example, money market funds earned 5%-8% on 2023, and it is literally impossible for MMFs to go negative. Certified deposits offered up to 5.5% guaranteed returns. The benefit of pensions is that employees don’t need to learn all that and make those choices in order to benefit from them.

401ks weren’t a “mistake” they were designed to give wallstreet traders more money and for that task they have succeeded extremely well.

e: To the tune of $7trillion according to the article.

So my employer did this thing where new hires automatically got enrolled in a 401k. If you did absolutely nothing to your 401k, each year it would automatically up your percentage to a max of Y. Is that common or uncommon? And in this world of 401k over pension, should that be more of a norm to help protect people that don’t know better build retirement savings. It doesn’t solve the problem of folks not having enough money and needing to use 401k for emergency funds…

It’s common among good employers, but unfortunately a lot of companies don’t do it. We should be encouraging more of this because people tend to suck at preparing for retirement.

And while it doesn’t solve the emergency fund issue, people tend to adjust their spending based on how much lands in their account. This is called the hedonic treadmill, where people adjust they lifestyle to fit their means on the way up, but they struggle to adjust it back down. Automatically increasing investments just reduces the impact of a raise, it doesn’t actually reduce your actually income since it just pulls 1% out of your normal raise (probably 3%).

The proper solution is for people to learn to properly budget and cut out things that don’t provide enough value, but that’s a much harder problem to solve than automatically increasing investments.